Organized retail crime is an ongoing challenge for retailers, with losses continuing to mount

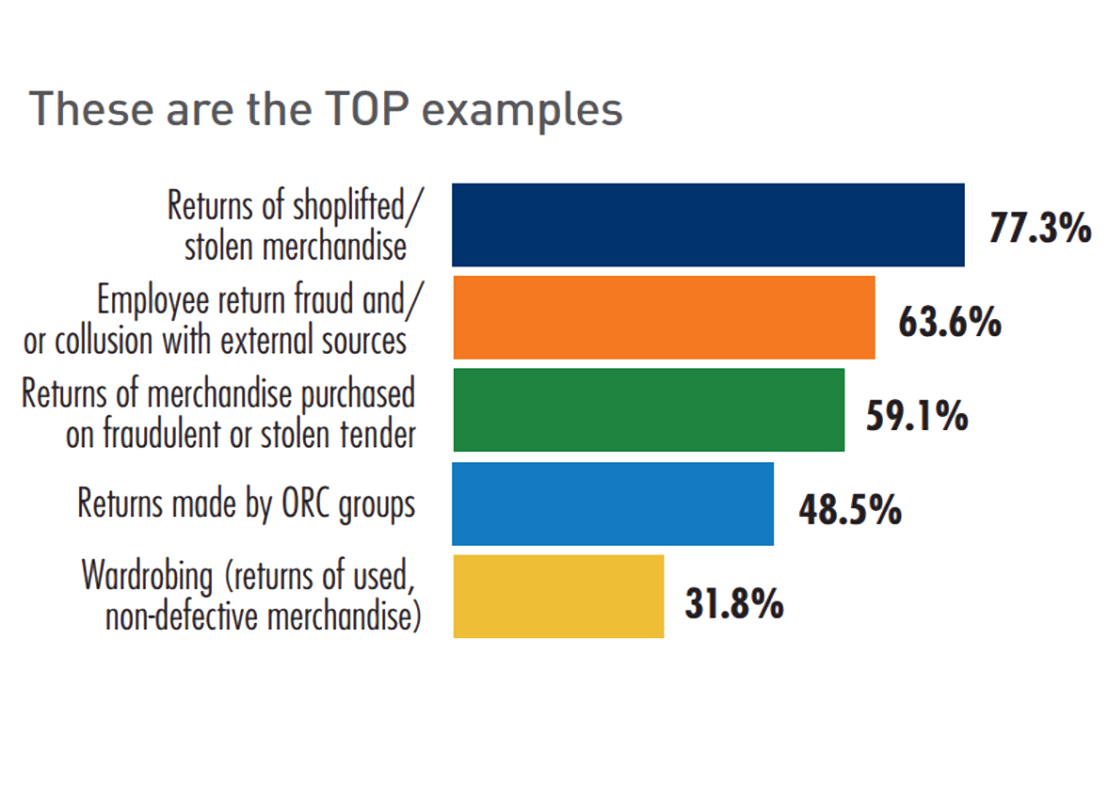

Retailers report ORC gang members are increasingly bold in their tactics. It is a combustible combination — one that requires loss prevention professionals to stay one step ahead during a time in which budgets are tight and laws are less and less of a deterrent. ORC costs retailers $777,877 per $1 billion in sales — an all-time survey high. While criminal rings have multiple ways of stealing from retailers, the most prominent type of return fraud involves taking merchandise and returning it for a refund. In all, survey respondents expect that about 11% of annual sales will be returned and 8.2% of those returns are fraudulent. ORC criminals may have a myriad of techniques, but there is one commonality: Retailers report increased aggressiveness exhibited by ORC gangs. Similar to 2017, roughly half (48.5%) of survey respondents said ORC gangs are exhibiting more aggression than they did the previous year. About 45% believe it is the same as last year. Retailers employ a variety of methods to combat ORC. Almost six in 10 retailers say they will allocate additional resources to address ORC — up from four in 10 the previous year. Technology solutions are the most frequent tool, with staff increases a close second. For the upcoming holiday season, staff training and awareness top the list for preventing loss, along with innovative ideas like working with product teams to ensure high-theft items are displayed away from doors. Policy changes — including returns, trespassing and point-of-sale — also have been adopted. More than one third — 37.9% — have made changes to their point-of-sale policy. This level of investment in combating ORC is a mixed bag. The majority — 55.2% — of LP teams do not have staff dedicated solely to ORC. For those who do, the investment is high — an average of 11 employees. A bright spot: More LP professionals say upper management understands the complexity and severity of ORC, up slightly over 2017. More than seven in 10 — 72.7% — see the need for a federal law to combat organized retail crime. In some ways, LP is going alone on this sizeable area of retail crime. In some states, the felony threshold has increased — raising the dollar amount of theft before the crime is considered more serious than a misdemeanor fine. In states where the felony threshold has increased, the majority of retailers report an increase in the average ORC case value. Some states have enacted anti-ORC laws. But even in these areas, retailers report very little police assistance in the investigation; most often, it is from the local police force.

Organized Retail Crime’s High Price

Organized retail crime is widespread for today’s retailers, with over nine in 10 respondents saying they have encountered ORC in the last 12 months. The 2018 National Retail Security Survey, released by NRF in the spring, showed shoplifting — including ORC — as the top source of inventory shrinkage for the fourth year in a row. In that report, retailers attributed 35.7% of inventory shrinkage to shoplifting and other external crimes. This report focuses exclusively on ORC and its increasing impact on a retailer’s bottom line. ORC ACTIVITY CONTINUES TO INCREASE Nearly three in four retailers (71.3%) have seen an increase in ORC in the past year, and more than one third of retailers who had experienced ORC activity say ORC has increased “significantly.” Almost one-fourth — 24.2% — say there has been no change in ORC activity over the past year. Only 4.6% have seen some level of decline over the past year.

It’s clear that ORC continues to be a growing and costly problem for the retail industry. The increase in average case value to retailers is up over the previous year — from $726,351 per $1 billion in retail sales to $777,877 —and the average cost is up from 2015’s $453,940. The median cost has held fairly steady over time. Given the tight margins facing most retailers, any loss of revenue can negatively impact a company’s stability. Why does ORC retail crime continue to increase? Respondents offered their thoughts, which coalesced around a few broad trends:

● Ease of theft/resale: Ease of the activity is explicitly mentioned in terms of either stealing product or selling it, mostly online (with social media getting several mentions).

● Gift cards: Gift cards or policies related to them have made it easier to steal from retailers.

● Laws: Several states have raised the threshold for felony thefts, and criminals have responded accordingly.

● Lowered defenses: Retailers say they often are unable to counteract the problems due to staff shortages, a “do-nothing” policy and lowered supply chain security.

● Product: Brand names and/or demand for specific products can bring an increase in ORC cases.

Organized Retail Crime’s Top Target List

While retail criminals take advantage of opportunities, there are products they prefer and places they are more likely to target. The listing of top items stolen by ORC gangs shows they target a mix of high-end products (designer clothes, top-shelf liquors, and designer handbags) and day-to-day necessities (baby formula, deodorant, and razors). The order of items desired by ORC gangs hasn’t changed much over time, with designer clothes continuing to top the list.

Top Targets Continued

No surprise: The country’s largest cities are the most frequent targets of criminals. New York returns to the top spot, trading places with Los Angeles. Miami inches up a spot to number three, while Chicago also lands a bit higher, tying with Houston at number four. San Francisco/Oakland rounds out the top five. Outside the top five, other cities that are not among the largest populations emerge. By population, Orlando is the 72nd largest city, according to 2017 U.S. Census Bureau data, but it lands at number eight on the list of places where ORC most frequently occurs. Baltimore, the country’s 30th largest city, also appears in the top 10 of highest ORC activity. Respondents were asked to list the top 10 cities where they were most impacted by ORC. In addition to cities most frequently mentioned, the rankings yielded an “honorab.

Of course, not all returns are fraudulent. But consumer behavior provides cover for criminals. Customers often attempt to return items without a receipt; an estimated 11.8% of all returns, on average, are missing the receipt. Of those, more than two in 10 are expected to be fraudulent. Retailers may attempt to reduce fraudulent returns by providing a gift card or store credit rather than a refund, a popular option when a receipt is not present. But more and more, those gift cards and credits are sold, often online. This method may slow the thief from getting the cash, but the result is ultimately the same: They end

up with the dollars from the stolen and returned merchandise. Fraudulent returns, however, have dropped slightly to an estimated average of 8.2% of all returns. That’s down slightly from 10.8% in 2017 and more in line with 2015 figures.